Rate cuts and the Market

Posted by PollyAnna Snyder on

Anyone that bought in 2018 or early20 19 (or has a rate above 4.25%) it is highly likely they can benefit from the lower rates. These rates may continue to drift down, or if the virus scare abates and markets rebound we may go back to where we were a few weeks back.

BUYING POWER: in a market like ours where prices move up by 7-9% per year and wages do not, buying power is diminished......lower rates help to offset that of course.

Example: a loan amount of $350,000 with a rate of 4.125% with Principle & Interest of $1696, borrowing power can go up to $378,000 at 3.5% while the payment stays $1697.

Pay attention to the mortgage rates, it could be a big win for you during this time!

441 Views, 0 Comments

On Wednesday, August 14, 2019, the Federal Housing Administration issued an update to its condominium rules, which go into effect October 15, 2019. The FHA said it expects the updates, which are intended to improve access to affordable and sustainable housing, will allow an estimated 20,000 to 60,000 more borrowers to qualify for condo loans.

On Wednesday, August 14, 2019, the Federal Housing Administration issued an update to its condominium rules, which go into effect October 15, 2019. The FHA said it expects the updates, which are intended to improve access to affordable and sustainable housing, will allow an estimated 20,000 to 60,000 more borrowers to qualify for condo loans.

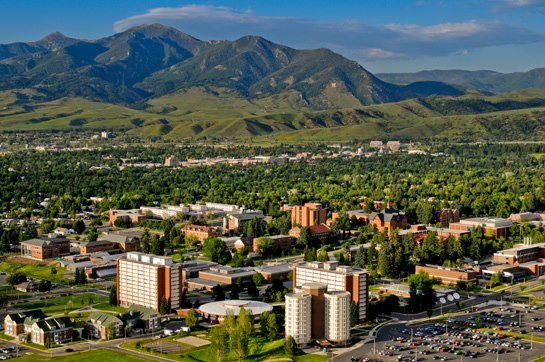

In an article in the Bozeman Chronicle recently, Bozeman’s economy was ranked the strongest in the nation for a micropolitan city for the third year in a row in a recent national report.

In an article in the Bozeman Chronicle recently, Bozeman’s economy was ranked the strongest in the nation for a micropolitan city for the third year in a row in a recent national report.